With cars expected to go electric over the next 10 years, automakers like Tesla are now looking to do the same with trucks. China is also exploring alternatives, with some calling for the use of methanol as a replacement fuel for diesel.

The technology for using methanol has been in development for over 40 years in China and may offer a cheaper route to “greener” trucks. But so far it’s failed to reach the market, held back by local vested interests and technical constraints.

China showed its commitment to developing methanol fuel by issuing national standards for its production in 2009. But you won’t see any methanol-powered trucks on the roads despite the fact that diesel vehicles, notably trucks, are still a major contributor to China’s air pollution.

So what obstacles have hampered methanol use and is the fuel still worth pursuing given the current buzz about electric trucks?

The advantage of methanol over diesel is that it produces fewer pollutants when burned. The fuel is a liquid made from synthesising carbon monoxide and hydrogen from oil, coal or biomass, which means it can be made with coal and biomass resources from within China.

Methanol works in combustion engines and has been widely used in motorsports. Currently, it offers a much cheaper alternative to electric trucks for long haul transport because there is no requirement for expensive and heavy batteries.

Whether the future of trucking is based on methanol, batteries or another energy source such as fuel cells, the pollution from diesel engines must be addressed.

Diesel vehicles only account for one tenth of China’s total fleet of 295 million vehicles but in 2016 they caused 68.7% of all vehicular emissions of nitrogen oxides and over 99% of primary particulate (PM) emissions. Other research by the Beijing environmental authorities in 2014 found that vehicles were responsible for two thirds of the PM2.5 pollution – particles smaller than 2.5 microns – in the city.

Heavy goods vehicles account for the bulk of diesel vehicles. The primary method of reducing emissions from diesel trucks is the installation of emissions-reducing equipment and spot checks to ensure compliance. But this complex system has proved to be ineffective.

In the hugely popular 2015 environmental documentary Under the Dome, former CCTV anchor Chai Jing accompanied law enforcement officials on spot checks. She found that many diesel vehicles display stickers indicating they meet China’s Stage IV emissions standards – when in fact they’ve taken no measured to reduce emissions.

Vehicles that aren’t fitted with equipment to reduce particulates often have levels 500 times greater than the Stage IV standards allow – and that ignores other types of pollutants such as nitrogen oxides.

“Widespread – or even pervasive – fraud is the industry’s secret,” said Li Kunsheng, head of the vehicular emissions office at Beijing Environmental Protection Bureau commenting in the documentary.

Government authorities have responded to the problem with more spot checks and pollution monitoring but some argue that more drastic action is needed. One option is a complete switch over to methanol fuel.

Is methanol the answer?

Methanol burns more cleanly than diesel to produce less carbon dioxide, nitrogen oxides and particulates.

And methanol is cheap to produce. Wei Anli, deputy secretary of the China Internal Combustion Engine Industry Association estimates that converting a heavy goods vehicle so that it can run on methanol and diesel would cost between 20,000 and 25,000 yuan (US$ 3,000-3800), while the fuel itself is three yuan a litre – half the cost of diesel. He suggests that for an average annual distance travelled of 200,000 kilometres, a vehicle that had engines to burn methanol and diesel would recoup its conversion cost in four to six months.

But there are problems with using it too. Methanol is harder to ignite and requires careful storage and distribution because it’s corrosive.

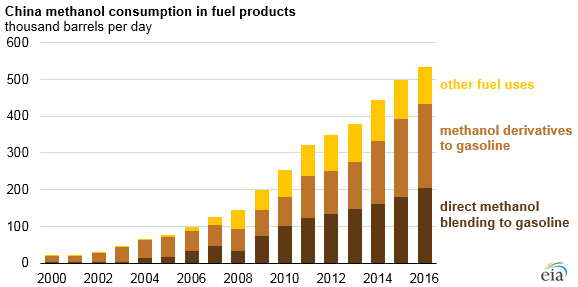

Source: US Energy Information Administration, based on Argus Media Group

China invests in methanol

In 2009 the Standardisation Administration of China, the central government body responsible for industry standards, issued regulations for methanol fuel (covering 100% methanol and an 85:15 mix of methanol and diesel, known as M85), giving methanol vehicles legal status.

Local governments set up methanol production facilities as it was thought that methanol could reach 10% of the market. In 2012, the Ministry of Industry and Information Technology held successful trials in Shanxi, Shanghai and Shaanxi provinces, with Guizhou and Gansu later included.

US energy expert Michael Krancer once pointed to China’s success in developing methanol vehicles to call for the US to take its own methanol sector more seriously.

But despite the research and pilots, methanol vehicles are still struggling to reach the market. Less than 50 methanol service stations operate in China today.

Less than 50 methanol service stations operate in China today.

A lack of joined-up government

Methanol is classed as a type of new energy and so falls under the jurisdiction of the National Development and Reform Commission’s National Energy Administration (NEA).

This means that standards for the usage of methanol as a vehicle fuel require the NEA’s approval. However, development has stalled due to rival interests in ethanol fuel, which tap into provincial government rivalries. Ethanol is produced using corn which grows in abundance in the country’s poor north-east, an area the government has made a priority to regenerate. Therefore, there is an interest in promoting ethanol over methanol in some areas.

There are other problems with bringing methanol vehicles to market. The use of methanol as a fuel requires the installation of a methanol tank and a separate engine to combust it – but the Road Safety Law forbids changing the structure of a registered vehicle.

Unfortunately, this impasse looks set to continue. The Ministry of Industry and Information Technology (MIIT), the Ministry of Transport and the Ministry of Science and Technology maintain that there is nothing they can do to resolve the problem.

A lack of policies to promote methanol mean that such vehicles miss out on generous state subsidies for new energy vehicles. The MIIT’s definition of a new energy vehicle includes fully-electric vehicles and plug-in hybrids, which are driven by electric motors, but does not include alternative fuels.

This weak policy support means investors have sidestepped methanol. He Guangyuan, former head of the National Machine Industry Department, said in a 2015 interview with Economic Information Daily, “If we could come up with one tenth or even one hundredth of the policy or financial support given to electric vehicles for promoting methanol, it would be much better developed.”

Methanol’s dirty secret

Another problem is that even if China went ahead with a programme to convert trucks to methanol, the environmental impact of the fuel would still be controversial.

As China has limited oil reserves, it makes methanol mostly from coal. This is problematic, according to a Greenpeace report, because the coal-to-chemical industry is water intensive and highly polluting. Under the 13th Five-Year Plan, the sector’s carbon emissions are expected to increase four-fold to 409 million tonnes by 2020. This will challenge China’s ability to meet its domestic emissions reduction targets.

Greenpeace energy and climate campaigner Gan Yiwei says that “using coal to make fuel as part of the response to climate change or to reduce emissions is a mistake.”

Producing methanol from coal is simply less efficient and more polluting than producing gasoline or diesel from petrochemicals. Methanol may produce less vehicular pollution locally, but overall it’s worse for the climate.

Wei Anli argues that methanol production plants are relatively clean because the concentration the carbon dioxide, which constitutes 94% of waste gases, can be captured. However, any environmental advantages of methanol rely on the use of high-tech carbon capture and recycling equipment.

Li Jinxue also contributed to this article