In March, China issued a draft renewable energy obligation policy that assigns provincial quotas for hydro and non-hydro renewable electricity consumption. The new system assigns electricity users, including grid companies, electricity retail companies, and large end-users participating in direct power purchasing a percentage quota of their electricity that needs to come from renewable energy.

Users can prove they have fulfilled the obligations by buying renewable energy certificates (RECs), which are issued to renewable generators for each megawatt-hour (MWh) they produce. There will be separate renewable obligations for hydropower and other renewable energy (wind, solar, biomass). Users with an insufficient number of RECs at the year-end will be obligated to buy replacement RECs at a price proposed by power grid enterprises and filed with the National Development and Reform Commission.

The new obligatory renewable quota for generators has many merits, in our view.

The obligation

Importantly, the renewable obligation now has teeth. Provinces that don’t meet their obligation will be temporarily denied approval for new coal capacity (or see capacity approvals reduced), and will no longer qualify for designation as energy demonstration zones. Market participants, such as power retailing companies, that fail to meet quotas will see their participation in power trading reduced or cancelled entirely in the coming year.

Importantly, the renewable obligation now has teeth

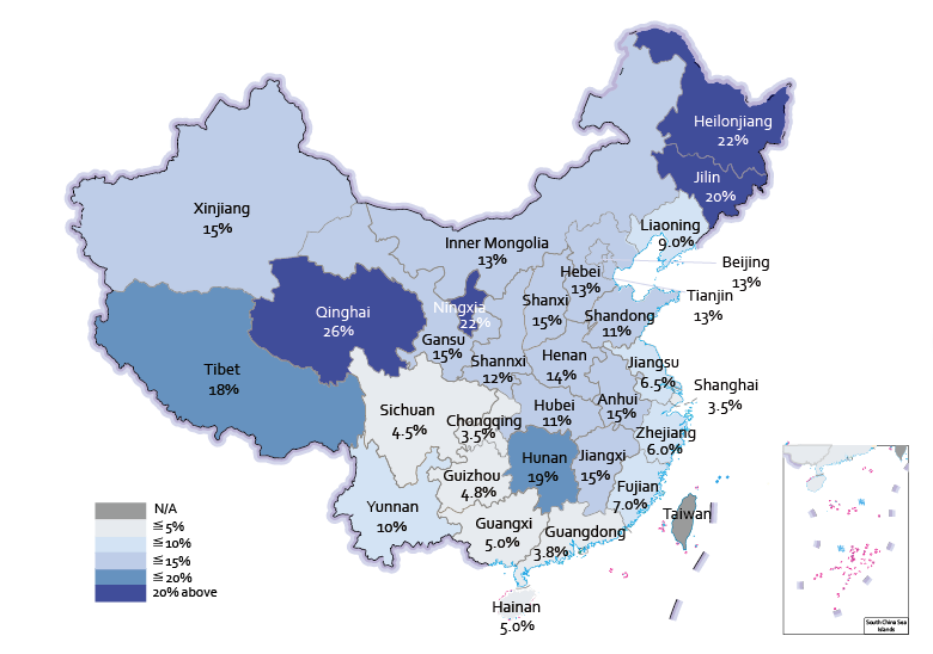

In the long-term, renewable obligations could help promote exchange of renewable energy between provinces. Many of the provinces that will see the largest increase in renewable energy quota are located in East China. For example, in 2016 Hunan province produced 2.9% of its electricity from wind and solar. Under the 2018 quota, Hunan will need to obtain 9% of its electricity from non-hydro renewable energy, rising to 19% in 2020.

A similar pattern is seen for Anhui, Henan, and Jiangxi provinces. In terms of absolute increase, Shandong, Henan, and Anhui will likely see the largest increases in purchase of wind and solar. Although increases in interprovincial volumes were already planned, eventually the renewable obligation policy could reinforce the importance of integrating renewables via cross-provincial transactions.

2020 renewable power indicator targets, by province (excluding hydro)

Source: GIZ 2018, based on National Energy Administration data

Source: GIZ 2018, based on National Energy Administration data

Overall, implementing provincial renewable energy quotas is a positive development that can help rectify several problems with China’s prior pattern of clean energy development. Targets based on output instead of installed capacity, already implemented at the national level, are an important part of encouraging renewable integration. Establishing penalties for non-compliance can also help resolve curtailment of renewable energy by encouraging provinces to import more clean energy rather than relying solely on in-province generation.

As for any new policy, there will be growing pains, and areas for potential improvement, especially once China’s renewable energy subsidies phase out after 2020. For this reason, we have suggested a few simple ways in which the renewable obligation policy can evolve. These are:

- Specifying how the quota policy will support other reforms that will effect renewable energy, such as carbon markets and power market reforms.

- Adding transparency around how the quotas are set and laying out a long-term path for quotas to encourage investment in renewable energy.

- Encouraging market development by providing monthly targets to help market participants stay on track with meeting their obligations.

- Clearly stating the objectives of the renewable obligation policy and aligning this objective with reducing curtailment of wind, solar, and hydro.

- Encouraging direct purchase of renewable energy and excess renewable energy certificates.

Study how markets will work in tandem

Any new market mechanism should contribute to China’s long-term goals of power market reform and clean energy policy. The proliferation of market, subsidy, and administrative planning mechanisms existing side-by-side has the potential to make market reforms more complex and therefore difficult to implement.

As the International Energy Agency (IEA) wrote in a policy paper last year, overlapping policies “can create duplication, increase cost, lower efficiency, and reduce policy clarity.”

Yet the IEA also notes that sometimes overlaps “can be justified if policies are aimed at different specific outcomes,” such as long-term and short-term goals. That is why it is important each policy specify its principal objective, and fits the supporting mechanism to this objective.

But we recognise that overlap is unavoidable. Where there are problematic overlaps, policymakers should develop an integration plan that harmonises these different policies over time. The most important policies to coordinate are carbon markets, spot power markets, ancillary services markets, distributed solar markets, and policies on air pollution. Many of these reforms will boost the amount of renewable energy coming online. Regulators should study how these markets will interact in the short-term, and clarify how these policies will mutually support one another.

The most important policies to coordinate are carbon markets, spot power markets, ancillary services markets, distributed solar markets, and policies on air pollution

Establish transparent, long-term policies

While China is shifting toward more market-oriented mechanisms to promote clean energy, China should not dispense of its long-term target setting approaches that have successfully driven renewables in the past. But these targets need to be adapted to improve long-term market performance.

Currently, the central government sets feed-in tariffs (FiT) and mainly adjusts them on an annual basis for various resource zones designated down to the county level. The uncertainty and lack of clarity in the FiT setting process has led to boom-bust cycles in investment. The zonal granularity has resulted in sub-optimal siting of wind and solar in zones where subsidies are high, but resources mediocre.

Regulators should focus on providing clear, long-term investment signals. In the recent renewable obligation, provincial quotas have just been set for 2018, a year already well underway. The government has only set “indicators” for 2020, which is when wind and solar plants approved now would likely come online.

Investors would benefit from greater certainty on targets out to 2025 or 2030. Currently the renewable obligation merely accounts for volumes already baked into plans, instead of using the REC help accelerate and optimise investment.

If renewable targets are known in advance and rise year-on-year, REC prices will signal the need for new investment, helping avoid lock-in of high-carbon technologies and potentially helping remove the need for feed-in tariffs and other administrative measures.

Of course, sometimes policy adjustment is necessary. But adjustments can be disruptive, especially if they become the norm, rather than the exception. We suggest setting out a regular timetable for reviewing quotas, and clarifying the circumstance requiring revision. Renewable obligations work well when a shortfall leads to higher prices, encouraging more investment. Thus when shortfalls happen regulators should not hastily change the following year’s goal, because that could cause an over-correction, and decrease investment.

Establish a monthly target

Deadlines for hitting administrative targets, although necessary, can also create unexpected problems. Feed-in tariffs adjusted once per year can lead to annual booms and busts around the date of the adjustment. Air quality targets set on a three-year term led to heating shortages in December of their final year. And provincial carbon market pilots have seen little activity until their end-of-year settlement obligations come due.

After the first year pilot, where RECs will be traded only once (from January-February of 2019), we recommend opening markets that trade throughout the year. This would enable market participants to see how prices are trading and react accordingly, rather than scrambling to meet quotas at year end.

We suggest regulators set guidelines that recommend monthly targets on how many RECs ought to be purchased per MWh of demand. Since wind and solar fluctuate monthly, the “escape valve” of the replacement credit, already designed into the proposed system, could be modified as a monthly rather than annual reconciliation.

Furthermore, a market with active monthly trading would help policy-makers monitor the progress of the renewable obligation policy. If RECs are consistently too scarce or abundant policy-makers can refine market rules to increase liquidity, or, if significant scarcity or abundance occurs over several years, they could propose a target change for the future.

Since there is currently no resale allowed and likely won’t be for a while, buyers will be reticent to buy in monthly markets, since if they overbuy they cannot resell. Therefore, we suggest initially targeting monthly procurement from about 25% in 2019, rising to 40-50% in 2020. This would help ease purchasers into more proactive procurement decisions.

Reducing curtailment

The stated objective of the policy is to help create an ecological civilisation and implement the nation’s clean energy law. In China’s case there is an opportunity to link the obligation to previously-stated plans for reducing wind and solar curtailment to below 5% in all provinces in 2020. In our view, the current targets can be met without any large reductions in curtailment, which is overly modest considering provinces with the most renewables need to reduce their curtailment from over 30% to 5% in two years. We suggest the target calculation formula currently used for this initial REC market phase (2018-2020) should include curtailment reduction targets.

Ultimately, hitting curtailment targets requires an increase in inter-provincial trade, since the most heavily curtailed provinces have far more generation than is needed to meet their internal demand. But other provincial governments would rather rely on in-province generation. And even for provinces that need to import their energy, rules around how imports are dispatched limits renewable integration to around 40%.

The REC policy could help tackle provincial protectionism by setting targets that require more renewable imports. The current targets appear to assume no unplanned increases in cross-province transactions. In future years, the renewable obligation could help put pressure on dispatch and power system engineering to increase China’s ability to incorporate more than 40% variable renewables across power lines.

The existing 2018 quotas appear conservative, perhaps because they are intended to ease the initial roll-out of the system. We believe there may be too much “slack” in the targets, that may actually complicate market development if quotas are too easy to meet.

To determine how much these targets should be revised, it is important to know the data used when setting these targets. We suggest that the basic formula for establishing provincial quotas for the next two years be made public. This will also help provincial dispatch centres understand exactly what they need to do to hit these targets, which is especially important given other ongoing changes in power markets.

Encourage direct purchase

The renewable energy obligation established by this new policy is separate from last year’s voluntary green certificate policy. The certificate policy intended to reduce the feed-in tariff subsidy deficit by encouraging private companies to buy certificates to advertise their green credentials. On a typical day, no green certificates are sold, and this earlier policy has not made a significant contribution to reducing deficit.

The major reason the green certificate market hasn’t worked is that the certificates don’t actually meet most companies’ requirements. Most environmental organisations evaluating the environmental commitments of companies focus on the issue of “additionality": when a company claims a green credential, have they truly taken an action which will bring more clean energy into the system than would exist otherwise?

China’s green certificates resemble a tax payment to the government rather than an investment in new clean energy. Paradoxically, the scheme’s design pushes green-minded multinational companies to develop renewable energy in other countries rather than in China. For example, Foxconn recently announced that it will invest in a massive new solar project in Saudi Arabia.

We believe the new REC policy can eventually absorb the green certificate market, especially since the current REC policy better suits corporate needs. To help with this transition, we recommend allowing companies and cities seeking an early peak to carbon emissions to voluntarily purchase renewable energy certificates above the provincial quotas.

We also suggest allowing companies to do direct purchase agreements with renewable energy sources outside the quota system. Such markets would encourage greater investment in renewable energy, help bring down prices for wind and solar, and potentially accelerate China’s clean energy transition.

Conclusion

China is working all out to pursue a clean energy future and has achieved much more than most countries have. The nation is the leading producer and consumer of renewable energy today and China’s clean energy manufacturing scale-up has helped enable the global energy transition. The draft renewable obligation policy continues this support. It sets the stage for a market that can gradually evolve into a platform for driving renewable energy investment and production. We hope these few suggestions provide a starting point for that evolution.